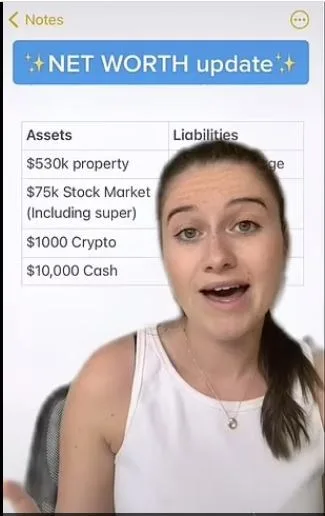

Boomers might say youth is wasted on the young, but Gen Z have a smart retort. According to them, retirement is wasted on the old – and they’re no longer willing to sacrifice the prime of their lives in a drab office cubicle. Take 26-year-old Cherry Tung, for example. Each morning, Tung wakes up, meditates and performs her daily cacao ceremony. Then, instead of sitting in front of a monitor for eight hours in a low-paying, high-stress corporate gig, Tung fills her agenda with workouts, social catch-ups and travel plans. At 6pm, as commuters fight through crowded train platforms to get home, Tung relaxes in a massage chair and writes in her gratitude journal, before commencing a three-step skincare routine. No, Tung isn’t living the high life thanks to a lucrative trust fund, nor is she part of a sugar-daddy arrangement. The reason the former accountant has all this free time is because she retired at age 25.

Earlier this year, a sound bite of Kim Kardashian exclaiming, “It seems like nobody wants to work these days,” went viral. And if you’ve spent any time on TikTok lately, you’ll know young people want out.

Tung is part of a booming online community called FIRE (Financial Independence, Retire Early), championing quitting work well before your twilight years. The approach, which has been around since the ’90s but has made a recent revival on social media, relies on aggressive saving, über-strict budgeting, and methods for diversifying your revenue streams and creating a passive income, such as flipping clothes, investing shrewdly in crypto and the stock market, and signing up for medical trials. Scroll through hashtags such as #retirebefore30 and #earlyretirement and you’ll find bright young things offering their financial advice so that – like them – you can ditch your day job.

Melbourne-based schoolteacher Olivia Fitzpatrick first heard about the FIRE movement while listening to a podcast. “It was a big light-bulb moment for me, to find out you could retire earlier than 65,” the 28-year-old says. Since joining the movement, she cemented herself on the property ladder at 25 and expects to retire in her thirties.

For Fitzpatrick, it’s the idea of financial independence that keeps her motivated. “It’s not necessarily to retire early, sit around and watch Netflix,” she explains. “It’s more about the freedom of your own time and the financial ability to choose if you are working, when you’re working, and what you do for work.”

Award-winning financial adviser and host of the She’s on the Money podcast Victoria Devine explains that you only need to look at the effect of “the great resignation”, the death of the #girlboss era and end of side-hustle culture to see why young people are planning an early exit strategy. “I think we’ve worked out that it’s a bit ‘hamster on a wheel’ to go to work nine-to-five, Monday to Friday, and then retire at the age of 65,” she says. “We’ve seen past generations do that and not be happy. Now we live in a world where that doesn’t have to be our reality.”

While the benchmark of a sustainable, passive income differs depending on your lifestyle, the generally held advice is that you need a net worth of 25 times your annual cost of living to be able to live off your savings.

According to Devine, if you are looking to retire early, you need to work backwards. So firstly, you must figure out how much money you want to live off each year. “For example, to achieve $120,000 in passive income each year [for 20 years], you would be working towards a portfolio of $2.4 million,” Devine explains. “Then it’s about working out how quickly you can achieve that within the parameters of your income. And that’s going to be very different for someone who earns $60,000 compared with someone who earns $180,000.”

Devine believes smart investing is the key to financial freedom. “It’s not about saving up a whole heap of money to then start spending it,” she says. “You need to invest a whole heap of money so that your hard-earned cash is making money, so you don’t have to work a full-time job.”

Like many things that sound too good to be true, there’s a catch. For many FIRE followers, the cost of financial freedom means sacrificing a comfortable lifestyle to live strictly below their means. “There’s one person [I’ve come across] who’s currently living in a share house with 12 people earning like $100,000, eating beans and rice and not going out,” says Devine. “They’re living a socially reclusive life.”

It’s important to consider what you’ll lose if you tap out of the corporate world prematurely. “People report having lost motivation and a sense of connection with the world,” Devine says. “Work is a really social thing, and having a routine is actually really healthy for us.”

Tung admits she constantly feels the need to justify her new lifestyle. “There was a period of time when I questioned: who am I now that I don’t have a job title?” And Tung is not alone. In a FIRE community group on Facebook, one user recently posted, “I feel so lost right now. I spent so many years working and saving that I do not know what to do with myself. Part of me wants to find a new job. What do you do with your time?”

The extreme saving in your twenties can also lead to an unhealthy lifestyle, both physically and mentally. Tay (who goes by @taybeepboop on TikTok and Instagram) says she is still suffering trauma from her strict lifestyle. “I was living in the closet of an apartment with five people,” she recalls. “I’d go to sleep hungry, sneak onto the subway, make a bunch of fake email accounts to get the ‘first meal free’ deals. I almost sold my eggs.”

After years of squirrelling away her earnings and living below the poverty line to get ahead, Tay paid off her student loans and bought a condo in San Francisco at the age of 26, although she admits she still deals with the ramification of this restrictive period of her life. “I definitely have trauma from what I did to myself. I cry thinking about it. But at the same time, I have financial security now and that is damn near priceless. It’s hard to say if I would do it again, because I don’t know what the full damage is.”

It raises the question: is it worth sacrificing your twenties so you can put your feet up in your thirties? Perhaps Devine puts it best when she says, “The one thing that I’d be wary of is the sacrifice. Old age is a privilege that is denied to many people. And if you’re going to compromise the journey, there’s no guarantee the destination you’re working towards is going to be there when you arrive.”

‘I Tried The FIRE Life For A Week’

Harriet Sim, marie claire Australia’s features writer, gives living as frugally as possible a go.

I’m out with friends at a cosy French jazz lounge as they sit before plates decorated with chicken fricassee and garlic clams. The waiter whispers to me, “Are you sure I can’t get you anything else, mademoiselle?” I look down at the pitiful glass of tap water and assure the empathetic (or perhaps pissed-off) waiter that I’m happy with just the (free) beverage for now.

I’ve spent the past week road-testing some of the strategies from the FIRE community by living like a true frugalitarian. I’ve shopped exclusively in the clearance section of my local IGA, ditched the car for public transport and trawled through op-shop racks for a new work jacket. Result: I found a structured black wool Hugo Boss blazer, which was half price because it was in the men’s section (the injustice!). Lucky oversized is still in. I was breezing through this and starting to feel pretty smug when a friend invited me to dinner later that week.

So here I am in one of Sydney’s hottest new restaurants, full on the leftover spaghetti bolognaise I ate before I left home. As my friends sat there gushing over how well the brown butter and capers paired with the cod and how excited they were to try the sorbet for dessert, I realised that aside from having the worst case of food envy, I also felt isolated by not being able to partake in the experience.

While depriving myself of what would have typically been a fun evening with friends was hardly robbing myself of my best life, I still wondered how FIRE devotees justify early retirement at the price of their youth. And is working really that bad? Sure, there have been hair-pulling deadlines and a few tears shed on the company clock, but when I look back on my career, I feel pretty privileged. I’ve met lifelong friends, learnt invaluable lessons and even found love. Would I give it all up for a lifetime of leisure? Ask me in five years.

‘I Tried Early Retirement And Got Some *Very* Strange Responses’

Bree Player, marie claire Australia’s features editor, tries telling people she’s retired.

Here are two things I never thought I’d say: Kim Kardashian was right, and I don’t want to work. Even though I have what many would consider a dream job, the truth is I don’t dream of labour. I dream of lazy mornings in waterfront cafes, followed by a spot of shopping and a Pilates class.

I wasn’t always like this, and I really do love my job (and know my editor is reading this!). I’ll chalk it up to a combination of COVID stress, two years without a holiday and a string of previous jobs that were unbelievably demanding.

My first victim was a retail worker at a popular chocolate store a few days out from Easter. Clearly a busy week for him, he looked thoroughly depressed when I told him I was retired and spend my days as I please in response to him asking if I worked nearby. It was polite small talk from him and probably the hundredth time he’d asked that question during a long day on his feet. I felt like a total jerk and had to stop myself from telling him I had lied for a story.

For the purpose of this challenge, I downloaded Tinder to test what a prospective love interest may think of a retired young woman. Ben, 38, a human resources manager, was not impressed: “So you’re a trust-fund baby. People like you are the problem.” Also unimpressed was Julian, 41, a lawyer, who said, “You just do nothing? Sorry, but that’s a turn off for me. You sound like a gold-digger.” Wow. I’d forgotten how brutal online dating is.

A weekend down the coast at my sister’s place provided plenty of opportunities to road-test my retirement on unsuspecting people. Almost everyone I told responded with the same first question: “Do you have kids?” After telling them no, I’d see their eyes dart to the fourth finger on my left hand, because if a woman isn’t working, she must be raising children while a man funds her life, right? While I might feel ready to retire, apparently the world isn’t ready for single, retired, childfree me.

Puffed up and pissed off, I had almost forgotten how I felt in the chocolate shop. Then came the toughest question, from a recent seventy-something retiree: “How do you feel after losing such a big part of your identity?” It whacked me right down off my high horse. While I’ve come to learn in my thirties not to define myself by my career, it’s still a big part of who I am, and I get a lot of confidence and self-worth from my job. Looking at the bigger picture, maybe I’m not ready to retire. Maybe after two years of working through lockdowns, I just need a holiday.

The story originally appeared in the July issue of maire claire Australia.